Atlantic Yards

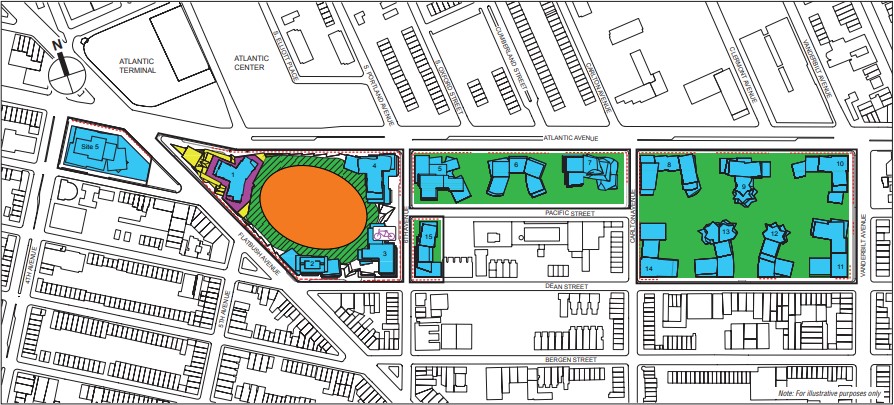

Atlantic Yards (Pacific Park) is a $6 billion project to redevelop 26 acres in and around the Brooklyn neighborhoods of Prospect Heights, Boerum Hill, Park Slope, Fort Greene and Clinton Hill. It was approved by the State of New York in December 2006. The project as approved includes the Barclays Center arena; sixteen towers (eight of which have been completed, and eight that have yet to be started); and eight acres of privately operated but publicly accessible open space (of which three acres are currently completed).

Ownership, governance and oversight

Atlantic Yards is a public/private partnership approved under the New York State Urban Development Corporation Act, and is overseen by Empire State Development (ESD), a State agency that reports to the Governor. The project was initially proposed in 2003 by Forest City Ratner Companies (FCRC). In 2014, FCRC sold a 70% interest in the project to Greenland USA, a subsidiary of developer Greenland Holdings controlled by the government of Shanghai; the project was then rebranded “Pacific Park Brooklyn,” to be developed by a joint venture known as Greenland Forest City Partners (GFCP). In January 2018, Greenland acquired an additional 25% interest. Forest City Realty Trust, the parent company of FCRC, was acquired by Brookfield Asset Management in November 2018.

In November 2023, it was reported that GFCP had defaulted on EB-5 loans totalling $285 billion. The loans were held by a combination of the original Chinese investors, represented by the U.S. Immigration Fund (USIF), and the private equity fund Fortress Investment Group, and were collateralized by two limited liability companies to which had been transferred the rights to develop six buildings over the Vanderbilt rail yard. The lenders moved to foreclose, but auction of the collateral was scheduled and then postponed several times. In August 2024, it was reported that USIF, Fortress and Related Companies would form a joint venture to develop over the rail yard, subject to approval by ESD. At the end of 2024, approval had not yet been given, leaving USIF and Fortress in control of the rights to develop over the rail yard, but without the ability to build. GFCP remained in control of Site 5, a block west of the Barclays Center arena bounded by Flatbush Avenue, Atlantic Avenue, Fourth Avenue and Pacific Street. In January 2025, it was announced that Related would not proceed with the project, and that USIF planned to work with Cirrus Real Estate Partners instead.

Approval under the UDC Act allows Atlantic Yards to bypass New York City’s Uniform Land Use Review Process (ULURP). UDC also enabled land to be assembled for the project using eminent domain, including land used for public streets. Neither the original Atlantic Yards plan nor any subsequent changes have been required to be reviewed by community boards, local elected officials, the City Planning Commission or the City Council. In fact, although Atlantic Yards is the biggest development project in Brooklyn, since its announcement in 2003, no elected official from the borough has ever voted on it. Instead, all changes to the Atlantic Yards plan are voted on by the board of Empire State Development, whose members are all appointed by the Governor. In 2014, as part of BrooklynSpeaks’ settlement with the State and FCRC, the State agreed to create a subsidiary of Empire State Development known as the Atlantic Yards Community Development Corporation (AYCDC) to oversee the project’s public commitments. Five of AYCDC’s fourteen board members are appointed by local elected officials. However, since that time, ESD has not complied with the requirement to convene the AYCDC board on a quarterly basis.

Development timeline and delays

The Atlantic Yards project was announced in December of 2003. After required environmental review, the project was approved by the State of New York in December of 2006; at the time, FCRC claimed the project would be complete by 2016. Although demolition of existing buildings began shortly thereafter, litigation challenging the use of eminent domain to assemble land for the project delayed the start of construction. After the financial crisis of 2008-2009, FCRC renegotiated the terms of its agreement with ESD. As a result of a lawsuit filed by BrooklynSpeaks, a court found the renegotiation violated New York State environmental law by extending the time allowed FCRC to complete the project from ten years to twenty-five years; the executed master development agreement showed that FCRC had been given until 2035 to complete the project. In 2012, ESD was ordered to conduct additional environmental studies to determine whether the extended build out would create additional impacts to the surrounding neighborhoods.

In 2011, FCRC announced plans for the first residential building B2 at Atlantic Yards. The building was to be constructed using modular techniques the developer claimed would reduce cost and speed completion of the project. Construction broke ground in December 2012, and B2 was expected to be ready for occupancy in 2014.

By 2014, completion of B2 had become significantly delayed due to problems with the modular technology; it would not be completed until 2016. In need of a partner for capital, FCRC planned to sell a majority interest in the remainder of the Atlantic Yards project to Greenland USA. The deal was contingent upon completion of the court-ordered environmental review and approval of the ESD board. ESD had refused to study the effect of delaying until 2035 the project’s affordable housing on Black populations of surrounding communities. Facing the threat by BrooklynSpeaks of litigation charging a violation of the Federal Fair Housing law, in June of 2014 ESD and FCRC agreed to settle by requiring all of Atlantic Yards’ 2,250 affordable apartments be completed by May of 2025.

Following the closing of the joint venture between FCRC and Greenland USA in July of 2014, Greenland Forest City Partners announced plans for the start of construction of three buildings, 550 Vanderbilt Avenue (B11), 535 Carlton Avenue (B14) and 38 Sixth Avenue (B3); all have since been completed.

In September 2016, FCRC CEO Bruce Ratner told Crain’s that the economics of Atlantic Yards “didn't turn out as well as we expected,” and that he would have passed on the project had he known the outcome beforehand. The next month, citing oversupply and weakness in the Brooklyn residential market, FCRC announced a pause in new construction at Atlantic Yards, and the recording of an impairment of $300 million against the value of its investment in the project, essentially wiping out all of its equity. The pause continued until January 2018, when Greenland acquired an additional 25% interest in the project, bringing its ownership up to 95%. A press release at the time stated that construction of the next building B4 would begin in 2019.

New buildings moved forward with other developers playing key roles. In October 2018, GFCP stated that buildings B12 and B13 would be constructed by TF Cornerstone, and B15 would be constructed by the Brodsky Organization. These arrangements were possible because Atlantic Yards’ master development agreements gives GFCP the right to sell leases for individual development sites; the $199 million raised was almost equal to the sum Greenland USA paid for its initial 70% stake in the Atlantic Yards project. In April 2019, it was announced that B4 would be developed as a joint venture between GFCP and the Brodsky Organization.

Six of the Atlantic Yards buildings–B5, B6, B7, B8, B9 and B10–are slated to stand on platforms constructed over an LIRR rail yard that occupies two blocks between Carlton Avenue and Vanderbilt Avenue, and Pacific Street and Atlantic Avenue. GFCP has stated that each platform will require three years to build. 877 of the project’s 2,250 affordable apartments required to be completed by May of 2025 are expected to be located in buildings on the platforms. In September 2019, GFCP stated that it planned to begin construction of the platforms in 2020; however, no such construction began. As previously mentioned, foreclosure following GFCP's default on EB-5 loans has caused development over the rail yard to be indefinitely delayed.

Barclays Center

In order to build political support for the Atlantic Yards project, original developer Bruce Ratner acquired the New Jersey Nets basketball team in 2004 and announced plans to move the team to a new arena to be constructed at Atlantic Yards. Ratner was allowed to sell the naming rights to the arena to Barclays in 2007 for $400 million over 20 years. FCRC also received a carve out in Federal tax law that allowed construction of the arena to be financed with tax-exempt bonds. In order to raise cash during the financial crisis of 2008-2009, Ratner sold an 80% interest in the team and a 45% interest in the then-unbuilt arena to Russian oligarch Mikhail Prokhorov in September 2009 for $200 million. This arrangement paved the way for the project to meet a December 2009 deadline to issue the arena bonds before the carve out expired. At the time of their issue, the bonds were rated Baa3 from Moody's and BBB- from S&P, the lowest investment grade. The investment-grade rating meant a lower interest rate for the developer. Barclays Center opened in September 2012.

In February 2016, Prokhorov bought FCRC’s remaining interest in the arena and the team for $288 million. After the sale, Prokhorov refinanced the arena bonds at a lower interest rate, saving an estimated $90 million. In 2018, Prokhorov sold a 49% stake in the Nets to Alibaba co-founder Joe Tsai for $1 billion. In August 2019, Tsai bought the remaining interest in the team and the arena from Prokhorov for an additional $1.4 billion. By the end of 2019, both S&P and Moody’s had downgraded the arena bonds to junk status.

Affordable housing

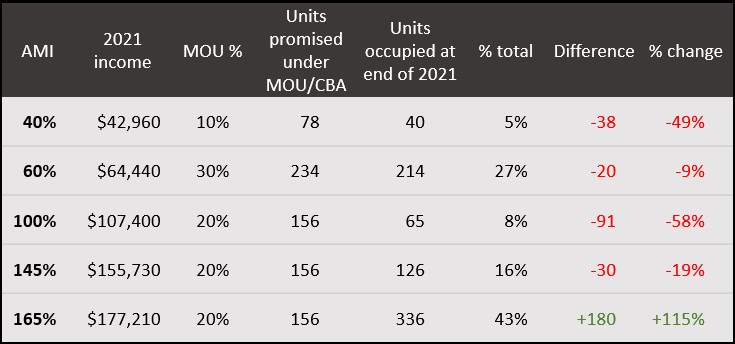

An even more important selling point for popular support at Atlantic Yards was FCRC’s commitment to develop half of the project’s initial 4,500 residential units as affordable housing. In May of 2005, FCRC signed a memorandum of understanding with ACORN memorializing this commitment. The MOU provided for the 2,250 affordable apartments to be offered to tenants with incomes ranging from 40% to 160% of Area Median Income (AMI). In November of 2005, FCRC stated that it would be adding up to an additional 2,300 market rate condominiums to the project.

In July 2006, FCRC and ACORN held an information session on Atlantic Yards’ affordable housing to an audience estimated at 2,300. A presentation stated that applications for affordable housing would be taken beginning in 2009, and the first buildings would be occupied in 2010. It also explained that “preference will be given to residents living locally, members of the NYPD, other City of New York employees, as well as mobility-impaired, sight-impaired and hearing-impaired people.” 2007 State legislation authorizing the 421a tax abatement provided for residents of Brooklyn community districts 2, 3, 6 and 8 to receive preference for half of Atlantic Yards’ affordable apartments in City lotteries.

The terms of the FCRC/ACORN MOU were not incorporated into FCRC’s 2009 agreement with ESD, which instead simply established a cap of 165% of AMI for all 2,250 “affordable” apartments. The first affordable apartments at Atlantic Yards entered the New York City housing lottery system in 2016. Since then, affordable apartments completed at the Atlantic Yards project have not been marketed in proportion to the levels agreed in the MOU, but instead have skewed sharply to higher income tenants.

The lack of affordability is further exacerbated by the large 76% increase in metropolitan AMI from $61,150 in 2005 to $107,400 in 2021. The relatively high rents for middle-income “affordable” apartments in Atlantic Yards buildings have been close to market rate units. Middle income apartments in buildings at 38 Sixth Avenue and 535 Carlton Avenue were not fully leased through the City lottery, so were offered on the open market; in the case of 535 Carlton Avenue one month of free rent had to be offered.

The buildings B4, B12, B13 and B15 received a tax abatement under the Affordable New York program (the version of the State 421a law passed in 2016 that expired in June of 2022), and elected to offer 30% of units up to 130% of AMI. However, the 2016 law no longer provided for any affordable housing preference for residents of the community districts surrounding the Atlantic Yards project, and none is planned to be offered for apartments in the four buildings. Prior to the expiration of the Affordable New York tax abatement in June of 2022, a Greenland representative stated that future buildings over the rail yards would require a tax abatement to be reauthorized.

Although FCRC committed to providing 200 affordable ownership units either onsite or offsite as part of Atlantic Yards, none have been delivered to date, and there are no known plans for GFCP to build them in the future. Neither of the organizations that signed the 2005 affordable housing MOU are still in existence; ACORN dissolved in 2010 after a video released purporting to show organizers engaged in election fraud resulted in Congress cutting funding to the group, and FCRC ceased operation when its parent company was acquired by Brookfield Asset Management in 2018. There has been no known attempt to hold GFCP accountable to honoring the terms of the MOU.

There remain 877 affordable apartments to be completed, which are expected to be provided in buildings to be constructed over the LIRR rail yards. In September 2019, GFCP stated that it planned to begin construction of the platforms in 2020. However, by the end of 2022, construction had not yet started. Under the terms of a 2014 settlement with BrooklynSpeaks, all of Atlantic Yards’ affordable apartments must have been completed by May of 2025, or GFCP will be obligated to pay $2,000 per month for every apartment delivered past the deadline. In June of 2025, ESD announced it would defer collecting liquidated damages of $1,754,000 per month from Greenland pending a new proposal being received from prospective developer Cirrus Real Estate Partners. Community leaders and elected officials called on ESD to honor the 2014 commitment to the community, and collect the damages, which are to be given to the City of New York to create and preserve affordable housing in the neighborhoods surrounding the project.

Open space

Plans for the Atlantic Yards project include eight acres of publicly-accessible, privately-owned open space. The open space is located internal to a superblock on blocks 1121 and 1129 on the eastern end of the project, as well as on block 1120 between Sixth Avenue and Carlton Avenue. Since the below grade LIRR rail yard occupies blocks 1120 and 1121, more than five acres of the open space is dependent upon construction of a platform over the yard whose start has been long delayed. Three acres of the open space around buildings B11, B12, B13 and B14 has been completed to date.

At the time of its 2006 approval, FCRC had retained landscape architect Laurie Olin to design the space; by 2008, Mr. Olin had left the project due to financial reasons. At the time Greenland USA acquired a 70% stake in 2014, it was announced that Thomas Balsley would be the landscape architect. At a public meeting in November 2019, officials with TF Cornerstone, the developer of lots B12 and B13, introduced a representative from Mathews Nielsen Landscape Architects as the landscape architect for the open space adjacent to its buildings.

The open space at the project is to be overseen by the Pacific Park Conservancy, incorporated in 2017 as a not-for-profit corporation. Its board includes representatives from Community Boards 2, 6 and 8, and a Parks Department representative. However, none have yet been invited to meetings of the Conservancy, where in any event they would be outnumbered by representatives from GFCP and ESD.

Expected changes to the project

The area to be developed as Atlantic Yards also includes Site 5, a block on the western end of the project site bounded by Flatbush Avenue, Pacific Street, Fourth Avenue and Atlantic Avenue. It includes a building formerly occupied by Modell’s, and another building currently occupied by P.C. Richard & Son. The Atlantic Yards Design Guidelines permit a building of a height of 250 feet to be constructed on Site 5.

The tallest building planned for the project, B1, was to be located at the southeast corner of Atlantic Avenue and Flatbush Avenue, in front of the Barclays Center arena; the Design Guidelines provide for a height of 620 feet for B1. However, the site for B1 is at a location currently occupied by the Barclays Center oculus and an entrance to the Atlantic Avenue subway station, and directly in front of the main entrance to the arena. It would therefore be very difficult to construct a building there today.

In November 2015, executives with FCRC began speaking publicly about a major development at Site 5, and in February 2016 announced their intention to seek a change to the Atlantic Yards project plan that would transfer the density planned for B1 on the arena block to Site 5. Together, the combined rights on both blocks could produce a building more than 800 feet tall. Programming for the site was described as high-end retail and office space, and compared to the Time Warner center.

Litigation filed by P.C. Richard to enforce the terms of a 2006 letter of intent between the retailer and FCRC guaranteeing P.C. Richard a space in a new building at the site delayed GFCP moving forward with plans for Site 5. In October 2021, the parties settled.

Transferring density from the arena block to Site 5 requires a modification to the general project plan, and an environmental impact statement. The only approval required, however, is from the ESD board, which is controlled by the Governor. More than tripling the density allowed at Site 5 would greatly increase the value of its development rights, which GFCP is allowed to sell under the terms of the project agreements. There is no requirement to construct affordable housing or provide any other type of public benefit at Site 5 currently shown in Exhibit M to the project agreements.

In August 2024, it was reported that an October 2021 development lease between ESD and GFCP included a provision under which ESD agreed to the transfer of over 800,000 square feet of bulk previously approved for arena block buildings B1, B2 and B3 to Site 5, for a total available bulk of 1.2 million square feet at Site 5, and a maximum building height of 910 feet. One million square feet would be allowed for residential use. No public announcement of the terms was made at the time, and the required environmental review was not performed.

The lease terms also allowed the Urban Room, a glass-enclosed atrium at the bottom of the unbuilt building B1 in front of Barclays Center, to be removed from the project. The Urban Room had previously been subject to a completion deadline of May 2022, with liquidated damages of $10 million for non-performance. In July 2022, BrooklynSpeaks and elected officials called on ESD to collect the damages. In its response, ESD made no mention of its agreement under the Site 5 lease to remove GFCP's obligation to build the Urban Room.